An impressive example of the results that can be achieved through Turkish-Russian cooperation in energy, the TurkStream natural gas pipeline is now ready to receive its first influx of gas on Jan. 8 at a ceremony in Istanbul attended by President Recep Tayyip Erdoğan and his Russian counterpart Vladimir Putin. The two-line project has already been loaded with gas and was initially conceived to replace, or at least diminish, gas flow from the Trans-Balkan Pipeline (TBP), which had been transferring Russian gas to Turkey and Europe via Ukraine. Although the future of TurkStream's second line is yet to be clarified in terms of when and how much gas it will transfer to the European system, its realization as a major gas pipeline project is expected to further strengthen European gas interconnectivity, hence contributing to continent-wide efforts for price convergence and market liquidity.

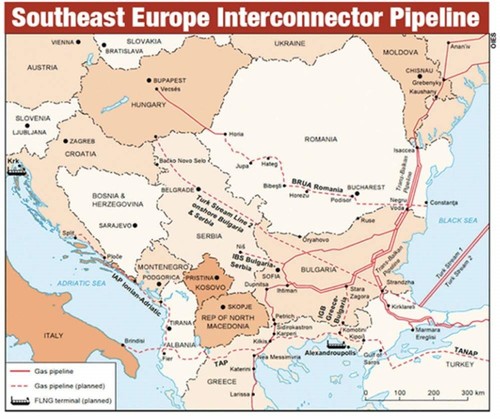

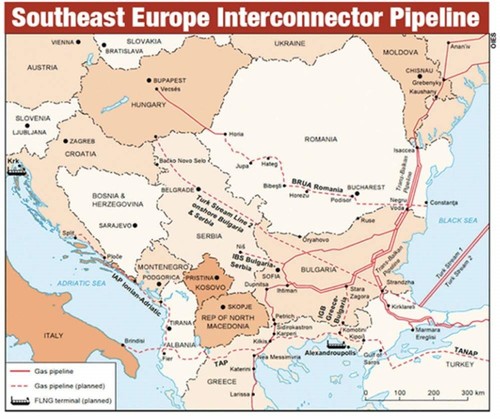

In an attempt to secure its foothold in the European gas market with new routes into southeastern Europe that bypass, or at least decrease, its key role in the delivery of gas to the continent, Russia embarked on the construction of two alternative pipelines, namely TurkStream and Nord Stream II. Europe's largest gas supplier, pumping out approximately 200 billion cubic meters (bcm) per year, Russia sees an advantage in supplying Greece, Bulgaria and the Republic of North Macedonia via the TurkStream II line's new interconnector at the Turkish-Bulgarian border, reversing gas flow in the Trans Balkan Pipeline (TBP), writes Julian Bowden, a senior visiting research fellow at the Oxford Institute for Energy Studies (OIES), in a recent report titled "SE Europe Gas markets: Towards Integration."

Once the first line of TurkStream's two routes become fully operational, gas moving through the TBP will be halted and diverted to the new pipeline, set to fulfill the project's initial purpose. "Reversing the TBP from Turkey to at least as far as Bulgaria would mean that Turkish Stream II could be used to supply current Russian gas clients, such as Bulgaria, Greece and the Republic of North Macedonia," Bowden explained in an exclusive exchange with Daily Sabah.

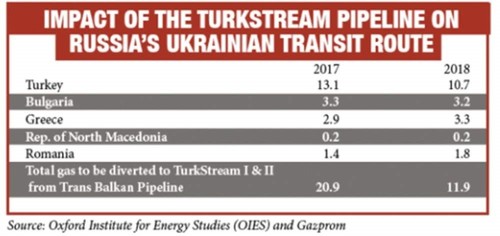

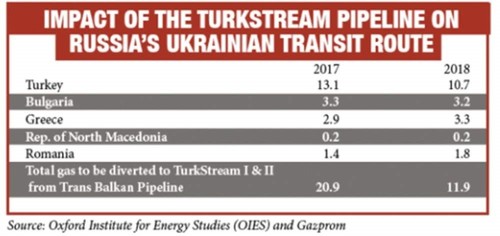

According to Gazprom, Russia's exports to Turkey via the TBP amounted to 10.7 bcm in 2018, while Greece, Bulgaria, Romania and Republic of North Macedonia received 3.3 bcm, 3.2 bcm, 1.5 bcm and 0.2 bcm, respectively. These figures signify that Russia will be able to divert 19 bcm away from the Ukrainian pipeline TBP. Based on these figures, Bowden argued that TurkStream will have a significant regional impact, changing the gas flow patterns. "The annual 25 bcm flow through TBP will become empty and up to 19 bcm per year will be removed from Ukraine transit throughout 2020," Bowden said.

The Ukrainian TBP pipeline was built in the 1980s and runs south from Ukraine along the Black Sea coastline through Romania and Bulgaria. In Bulgaria, the system splits into two legs: with the larger flow heading east to Turkey and a smaller flow westwards to Greece and the Republic of North Macedonia.

Over the next four to five months, the OIES academic remarked, the TBP could be emptied, with no more Russian gas flowing through it at all, as TurkStream's first line takes Russian gas directly to Turkey and the second can be roughly filled with gas for Bulgaria, Greece and the Republic of North Macedonia.

"Once the interconnection from Turkey to Bulgaria is completed and once any necessary technical work is done in Bulgaria to accept the reverse flow, then I see roughly 50% of TurkStream II capacity potentially being utilized," Bowden maintained, describing this step as an "investment light" part of moving the second line of TurkStream to Europe. The "investment heavy" part of this project, he argued, would come in the form of "building new lines through Bulgaria and Serbia for which the required capacity would be 8 to 10 bcm."

On Monday, Bulgaria announced that it would start taking deliveries of natural gas from Russia's Gazprom via the TurkStream pipeline as of Jan. 1, citing the economic benefits it offered Bulgarian consumers. The country claimed that it would save tens of millions of dollars per year in fees by avoiding transit through Ukraine and Romania. "We are changing the entry point for gas supplies from Russia," Energy Minister Tememoujka Petkova said.

Emre Ertürk, a seasoned energy consultant, also remarked that the second string of TurkStream would begin by supplying gas to Bulgaria and its neighbors – even for small volumes – early this year. "Since the second string of Turk Stream is temporarily connected to the Bulgarian section of the Trans Balkan Pipeline, the commencement of gas deliveries to Bulgaria will definitely restrict gas deliveries to Turkey's Malkoçlar entry point, and only Russian gas may be directed to this point by utilizing the recently launched spot pipe gas import regulation of Turkey's Energy Market Regulatory Authority (EMRA)."

The reversal of gas flow requires an 11-kilometer link between the Bulgarian network and the TurkStream pipeline along the border with Turkey, which was inaugurated in October. Moreover, also in October, Bulgaria's gas transmission system operator Bulgartransgaz signed a 1.1 billion euro ($1.24 billion) contract with the Saudi-led consortium Arkad for the construction of a gas pipeline to connect the country's existing gas transmission system to the border with Serbia, from which the gas will find its way to the Hungarian market.

Serbia's 400-kilometer pipeline, Gastrans, which connects the country's natural gas transmission system to those of Bulgaria and Hungary, was previously reported to be ready by mid-December this year and invited bids to book capacity in March. The technical capacity of Gastrans is 13.9 bcm per year, with three offtake points in Serbia totaling 3.8 bcm, leaving 10.1 bcm at its exit point in Hungary. In his report, Bowden argued that a reasonable earliest date for completion, financing, construction and commissioning of the Bulgaria-Serbia pipeline would seem to be 2022-23.

Furthermore, there persist regulatory obstacles over the extent to which Gastrans can be opened to third-party involvement. Serbia's energy watchdog Energy Agency of the Republic of Serbia (AERS) has allowed 88% of the capacity to be reserved for the exclusive use of Gazprom and Srbijagas. Yet, the European Union's Energy Community Secretariat (ECD) reduced the reserved capacity to 70%, or 9.7 bcm per year, to increase third-party access to 30% on the grounds that the deal between Gazprom and Srbijagas was against free-market regulations.

Once the entire construction of the necessary infrastructure is complete and Brussels finalizes the regulatory aspects of the pipelines with Serbia and Gazprom, the maximum utilization of TurkStream's 31.5 bcm capacity would be possible by the end of 2022, Bowden wrote in his report. If TurkStream becomes fully operational, it will make an additional cut of 12 bcm per year in transit through Ukraine on top of the aforementioned 19 bcm from early 2020, he pointed out. Flows through Austria's Baumgarten should remain unchanged, as gas diverted through TurkStream II will still enter Austria from Hungary.

While the Turkstream pipeline will surely reduce transit revenues for transmission system operators significantly, including Ukraine's $3 billion earnings from transition, it will facilitate southeastern Europe's interconnectivity through the building of a second-string capacity through Bulgaria and Serbia, paving the way for Russian gas to reach Hungary, Bowden's analysis demonstrated. The increased regional interconnectivity could even facilitate narrow price differentials. The EU's Agency for the Cooperation of Energy Regulators' (ACER) 2018 report published in October also stressed that sustained price differences between markets could, therefore, signal potential inefficiencies.

"The most obvious is a lack of sufficient physical interconnectivity, which, although to a lesser extent than before, still accounts for higher gas prices in certain parts of Europe," ACER explained. The lack of infrastructure, the agency warned, may lead to a concentrated market, where a dominant supplier – free of competitive pressure in the absence of alternative sources – can impose its market power. Therefore to ensure narrow prices in the European market, physical connectivity is certainly not enough. In some markets, like Serbia, dominated by a single monopoly and with no liquidity where third-party involvement is restricted, it is still less likely to ensure price convergence.

TurkStream for Turkey?

Turkey has been one of Europe's biggest purchasers of Russian gas with around 45% to 50% of its gas imports from Russia, totaling around 24 bcm per year. As Russia's plans on how to deliver its gas to Europe have evolved in order to divert routes from passing through Ukraine, with which gas flows have suffered as a result of political tensions between the two countries over the last decade, the idea of a route via Turkey was put forth.

Stipulating that the transfer of gas in accordance with previous agreements for the West Line would be directed to Turkey and, from there, onto the TBP via Bulgaria, the TurkStream agreement signed between Turkey and Russia in 2016 provides no room for price negotiations or the removal of a "ship or pay" clause, which has been the essential component of the long-term, oil-indexed gas contracts between the two countries.

Since the operational rights of the offshore section and the onshore section of the second string belong to Gazprom and its subsidiaries, Turkey is unable to collect any transition fee for gas which flows through here and onto the European market, according to Article 7 of the agreement. Article 8 outlines that the right to use 100% of the onshore capacity is vested in the Russian authorized organization, Gazprom.

"TurkStream will open a new transit route for Russian gas to Europe, but Turkey is unlikely to have much control over it since the offshore section of the pipeline will be controlled by Russia and Turkey will only have partial control over the onshore section of TurkStream II, from Kıyıköy to Malkoçlar-Strandja 2," Aura Sabadus, senior journalist at the ICIS – a commodity and energy intelligence company.

Although the TurkStream agreement submitted to the Turkish Parliament stressed that the project would strengthen Turkey's position as an energy corridor and contribute to its ambition to become a gas trading hub, Turkish import contracts have included a prohibition on local companies reselling the gas to other markets. "The EU has forced Russia to remove this clause from its supply contracts to European buyers because it goes against the principles of the free-market. However, the clause still exists in Turkish contracts and it may be kept on even when gas is diverted to TurkStream. This means that Turkish companies will not be allowed to resell the gas to other markets in the region, even if the Turkish domestic market would be oversupplied," Sabadus explained.

The inflexibility of oil-indexed prices in long-term contracts, as well as the contract's take-or-pay clause, have provided little room to create liquidity in the Turkish market and unbundling of contracts, constituting an obstacle for the further liberalization of the domestic market. All these factors, in the end, are cause to create a burden upon the Turkish energy budget and may result in high prices on household gas bills.

Some of Turkey's long-term contracts with Russia, corresponding to 16 bcm or around 30% of the total gas consumption in the country, are set to expire in 2021. In a global environment of growing liquefied natural gas (LNG) suppliers, Turkey is looking for multiple suppliers, expanding its purchases from the spot market to find the most affordable gas.

Between January and October of last year, the amount of gas imports provided to Turkey through the pipelines hit roughly 35.5 bcm, according to initial calculations based on EMRA data. LNG imports, on the other hand, slightly exceeded 10 bcm, accounting for nearly 25% of the total gas imports in the said period.

Energy expert Ertürk underscored that the upcoming period in the global gas markets will be marked by LNG glut. In this scenario, Russia will be making efforts to ensure demand security for its gas supply.

While Europe and Turkey have reinforced their infrastructure to allow for greater quantities of LNG imports over the years to ensure supply security, Russia will continue facing fierce competition from multiple suppliers, including the U.S., Algeria, Australia and Qatar, in addition to recently emerged gas producers, including Cameroon, Zimbabwe and Mauritania.

With suppliers vying for "demand security" in the face of such developments, Russia struck a five-year transit deal with Ukraine on Monday. The renewed agreement that the TPB will transfer 65 bcm of gas in 2020 and 40 bcm in the period from 2021-2024 shows that Russia has made its calculations in line with the expectations that Nord Stream 2 and TurkStream will operate at full capacity, 55 bcm for the first pipeline and 31.5 bcm for the second, while retaining a transit of 40 bcm through Ukraine.

"The agreement will not only help Russia boost its position in European markets at a time when LNG imports pose a serious threat to its market share, but also give it the option of several transit routes," Sabadus told Daily Sabah.

OIES senior fellow Bowden also argued that Russian policy mainly surrounds maintaining its market share in Europe and that it would be flexible on pricing to ensure this: "The new dynamic now is the pace of global LNG growth. If you have a global gas balance that sees the world having to absorb a lot of new LNG over the next say five years, then the overall price dynamic will be for a low price environment," he said and continued: "Russia will have to compete with this and is able to do so for numerous reasons, including a lot of production capability, a lot of fully depreciated pipelines."