© Turkuvaz Haberleşme ve Yayıncılık 2026

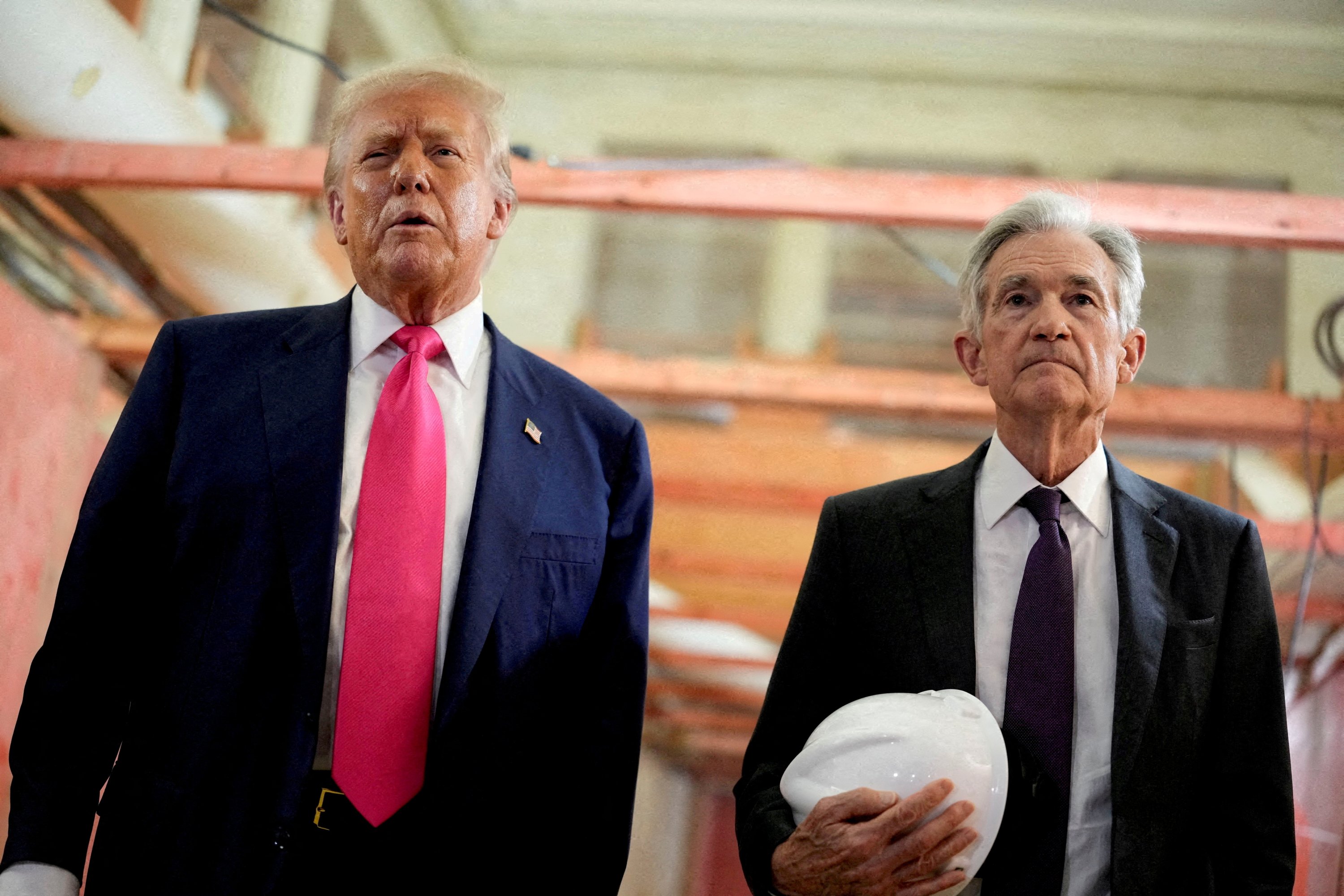

The tension between U.S. President Donald Trump and Federal Reserve (Fed) Chair Jerome Powell has once again returned to the forefront of global markets. I first addressed this confrontation on May 6, 2025, in an article titled “Trump vs. Powell: US economy is 'too big to fail,'” where I correctly anticipated that macroeconomic data would be the decisive factor ahead of the Fed’s interest rate decision on May 7.

The primary foundation of this assessment lay in historical precedent. Throughout past episodes of friction between U.S. presidents and Fed chairs – most notably during the Volcker era in the 1980s, the Greenspan years of the 1990s and the Bernanke period during the 2008 global financial crisis – Fed leaders consistently demonstrated a deep commitment to institutional culture and market-oriented decision-making.

While recent developments have carried this debate into new territory, the Trump-Powell tension should not be reduced to a personal dispute. Rather, it reflects the re-emergence of one of the most fundamental questions facing modern economies: Will politics govern the economy, or will politics accept the limits imposed by economic realities?

In this article, drawing on the eight months that have passed since that initial assessment, I aim to offer projections on how Powell’s final four months in office may unfold. That said, I have no intention of reinventing America. Instead, I believe it is both necessary and timely to revisit core concepts such as central bank independence, the role of interest rates, and the fundamental functions of central banks – not as abstract theories, but as pillars of economic governance.

It is crucial to underline that the real issue today is not what Powell will do next. The real question is this: Does the U.S. seek to govern the economy, or to govern interest rates? Because while politics may attempt to control interest rates, the economy itself cannot be governed by politics.

The year 2025 made it clear that political pressure on Powell was no longer confined to interest rate decisions alone. Instead, the very institutional framework and data infrastructure underpinning monetary policy increasingly came under scrutiny. Monetary policy functions not merely through interest rates, but through institutional credibility and statistical integrity that render those decisions meaningful.

Within this context, the Fed implemented three cautious rate cuts in September, October and December 2025, delivering a total easing of 75 basis points and bringing the policy rate down to around 3%. Contrary to political narratives, these moves were driven not by electoral pressure but by clear signs of cooling in the labor market and a deceleration in wage growth. At the same time, tariffs imposed by the Trump administration kept inflation elevated through cost channels, limiting the scope for a more aggressive easing cycle. As a result, Powell deliberately refrained from abandoning a market-oriented and data-driven policy stance, even while cutting rates.

Yet the core issue extended beyond the level of interest rates to the reliability of the data informing policy decisions. Trump’s public calls to remove the head of the U.S. Bureau of Labour Statistics, combined with government shutdowns, undermined the collection of timely and reliable economic data. Consequently, not only the Fed’s policy space but also its information base became politicized. In this environment, debates over the cost of the Fed’s headquarters renovation and calls for criminal complaints against Powell ceased to be isolated issues; they became interconnected elements of a broader challenge to institutional autonomy.

The resulting picture suggests that pressure on Powell has been directed less at the rate itself than at the Fed’s capacity to make independent decisions. When institutional spending, statistical credibility and monetary policy are all simultaneously drawn into political contestation, the issue is no longer the Fed building or even interest rates. The real question is whether a data-driven monetary policy can withstand the short-term imperatives of electoral economics.

Central bank independence is often treated as a technical arrangement or an institutional privilege. In reality, it is a far deeper statement of intent. Central bank independence is an institutional barrier drawn between the short-term interests of political power and the long-term stability of society. This barrier is not designed to detach the economy entirely from politics, but to prevent the speed, popularity pressures, and electoral incentives inherent in politics from derailing monetary policy.

Within this framework, independence rests on an internally consistent balance. Price stability is placed above the political calendar, because inflation does not concern election cycles but the continuity of social welfare. Interest rates are not political slogans. They are technical instruments. The core issue lies in the problem of time inconsistency: electoral cycles and economic cycles do not move in the same rhythm. Politics demands quick results. Monetary policy requires patience. This single sentence captures, in its simplest form, why central bank independence is indispensable.

The historical roots of this concept lie precisely here. Viewed through the U.S. experience, central bank independence emerged as a mechanism through which democratic systems sought to compensate for their own structural weaknesses. The high inflation episodes of the 1970s exposed the economic and social costs of the “cheap money plus popularity” cycle with striking clarity. The Federal Reserve’s deliberate distancing from politics over time did not stem from distrust in political authority, but from an acknowledgment of the risks inherent in the nature of power itself.

Independence, however, does not collapse overnight. Every political intervention, statement or indirect pressure leaves another notch on that institutional barrier. Central banks do not operate through coercion, but through credibility. Once credibility is lost, even technically sound interest rate decisions fail to restore trust.

This is not merely a domestic American issue. The position of the dollar, global capital flows and the vulnerabilities of emerging economies are directly tied to the Fed’s institutional posture. For this reason, the Fed’s independence functions not only as a safeguard for the U.S. economy but as an insurance mechanism for the global financial architecture.

Ultimately, modern central banking is about far more than the level of interest rates. Managing expectations, producing trust and reducing uncertainty through forward guidance have become the most powerful tools of monetary policy. Independence finds its true meaning precisely at this point: not merely the freedom to make decisions, but the institutional credibility and communication discipline required to stand behind them. A central bank that loses trust may still set interest rates, but it can no longer steer the economy.